Tax season is back. The following is a comprehensive guide on how to apply the IRF eFiling for annual income tax calculation for 2018/2019/2020.

As a taxpayer, make sure you do not miss the 21 list of tax exempt 2019 notified by the IRB.

eFiling is available starting March 1 each year. Individuals who receive a minimum wage of RM34,000 a year / RM2,833.33 a month, after EPF deduction are eligible for income tax.

EFILING IRB

A little introduction to IRF eFiling.

The system is intended to calculate the amount of taxable income, and the amount of income tax payable.

Through the eFiling system, you can fill out your own annual income, tax deductions (donations and gifts), tax relief and tax rebates.

In contrast to the previous system where you had to submit an assessment form and have to manually compute tax at the IRB office.

Here is the income tax payment procedure from iMoney.

HOW TO REGISTER FOR EFILING 2019/2020

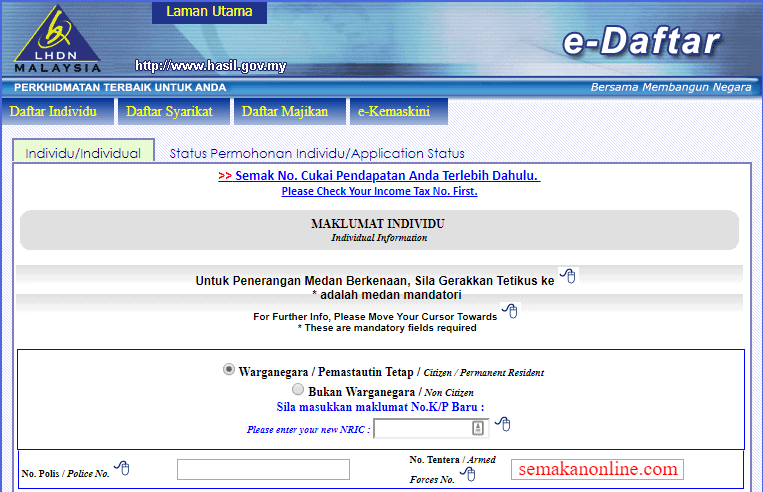

Registration can be made online through the official portal http://edaftar.hasil.gov.my

For first time users, please follow some simple steps below:

# 1 - Complete the online registration form

Visit http://edlist.hasil.gov.my/dafsgjpn.php to sign up for the first time. You'll be taken to the following page:

After this you will be given an application number eg Ai-a78629uf9797d23

Make sure you record the number to use when checking for registration status.

# 2 - Document upload required

You are then asked to upload a copy of the following document:

- Passports for non-Malaysian citizens who do not do business

- Business registration certificate for a Malaysian citizen doing business.

- Passport and business registration certificate for non-Malaysian nationals doing business.

When uploading your identity document, make sure that only the cover clearly shows the name and number. identification is required.

# 3 - Check application status

After a few days, you can review the online status of the application at http://edaftar.hasil.gov.my/info.php

If the application is validated, you will be given a PIN number that will be used when filling up the application later.

Warning: The e-Register application will be canceled if no complete document is received within 14 days from the date of application and the applicant is required to re-submit the new application along with the complete document.

HOW TO FILL EFILING

# 1 - Browse ezHASiL

Visit the https://ez.hasil.gov.my/CI/ portal and in the Sign in section please fill out all the required information and click Submit.

# 2 - Select an eBook

You'll then be taken to the eBook page. Here make sure you select the correct eBook:

- eE: Employer

- e-BE: A Malaysian citizen with no business income

- eBook: An Malaysian citizen with a source of business income

- e-BT: Knowledgeable Employee or Expert Employee of Malaysian nationality

- eP: Partnership business

- eM: Individuals who are not Malaysian citizens

- e-MT: Knowledgeable Employee or Expert Employee of Malaysian nationality

For those of you who work for a wage without a business, choose the e-BE form.

The information on the form is divided into four sections:

- Individual Information

- Statutory Income, Total Income And Income Recent Year Not Reported

- Release / Rebate / Withholding Tax / Withdrawal of Tax

- Summary

Please fill in all the required information. This is to simplify your income tax calculation process.

Finally you need to verify the assessment form and submit it to the IRB online.

In the declaration page like the picture below, you can choose whether to print the draft form as a PDF, submit an eBook or return to the previous page.

If you are satisfied with the completed form, please click “Sign In & Submit”.

When the Sign & Send button is pressed, the Signature screen is displayed. Enter the correct Identity Number and Password to submit the completed form. The upper or lower case letters should be exactly as specified earlier.

Complete your 2018/2019 income tax eFiling registration.

For more information, download the PDF how to fill out eFiling here https://ez.hasil.gov.my/CI/Guide/GuideCI_e Form.pdf

No comments:

Post a Comment